8 Charitable Donation Receipt Template

The 501 c 3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more. Charitable donation receipts are imperative documents especially for charity institutions because donations are non deductible for the donors.

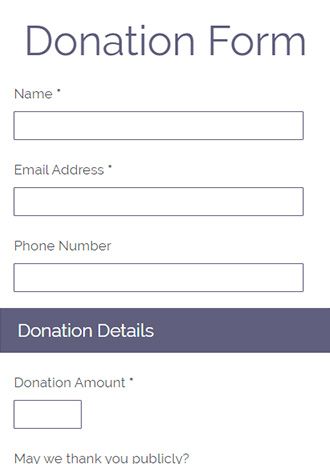

Donation Form Template Formsite

Donation Form Template Formsite

In order to be able to make your own donation receipt template youd have to know what exactly should be included in it.

Charitable donation receipt template. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual business or organizationprimarily the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal irs income tax. A donation receipt acts as a written record that a donor is given proving that a. Include a notice of receipt.

We can help you with the creation of a donation receipt template so you can easily send a receipt to all of your donors. Get started creating the perfect template for your charity with our online receipt maker today. The first paragraph should mention the notice of receipt addressed to the donor.

A donation receipt template is suitable for making your donations easier. When you design your own receipt based on our templates you should include the following information in the receipt. A donation receipt is an official document issued by an ngo or a charitable trust which can be provided to a particular person or an organization who has made the donation.

The name of the group organization or association along with its federal tin and a short notice which states that the group organization or association is registered. Information about the organization including logo name address tax identification number and a statement showing that the organization is a registered 501c3 organization. Donation receipt templates are essential to begin a charity.

It must contain relevant details such as the name of the organization donor amount of donation received and the signature of the donor. These are customized templates that can be used multiple times. One requirement is that you give donors a donation receipt also known as a 501c3.

The letter should state exactly what you received the worth of the item or the total amount when you received the donation and where you received it. The date the donation was made. You can make donation scripts digitally or use receipt templates available online which are printable too.

Its utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction. This helps them keep track of their donations and enables you to see how much each person contributed to your charity. An ideal donation script should include definite information about the amount of donation and what the donor received in return.

When accepting donations there are various requirements that your organization needs to meet in order to be compliant with the rules of your area. This will help you keep a track of the number of donations made. The donation receipt templates are fully customizable.

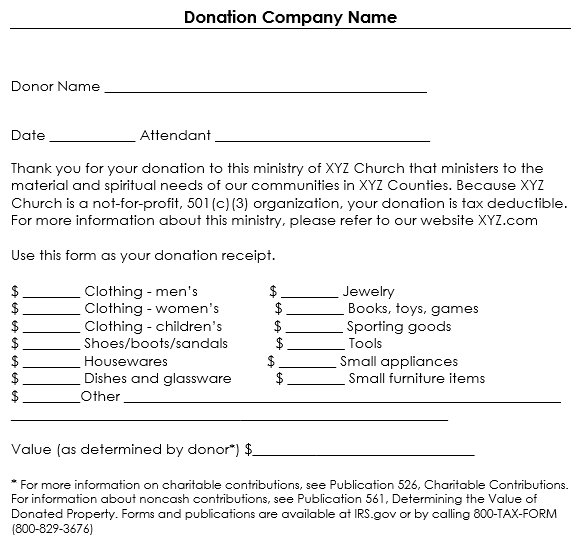

50 Free Donation Receipt Templates Word Pdf

50 Free Donation Receipt Templates Word Pdf

16 Donation Receipt Template Samples Templates Assistant

16 Donation Receipt Template Samples Templates Assistant

Donation Receipt Template For Excel

Donation Receipt Template For Excel

Charitable Donation Receipt Template

Charitable Donation Receipt Template

Donation Receipt Templates 17 Free Printable Word Excel

Donation Receipt Templates 17 Free Printable Word Excel

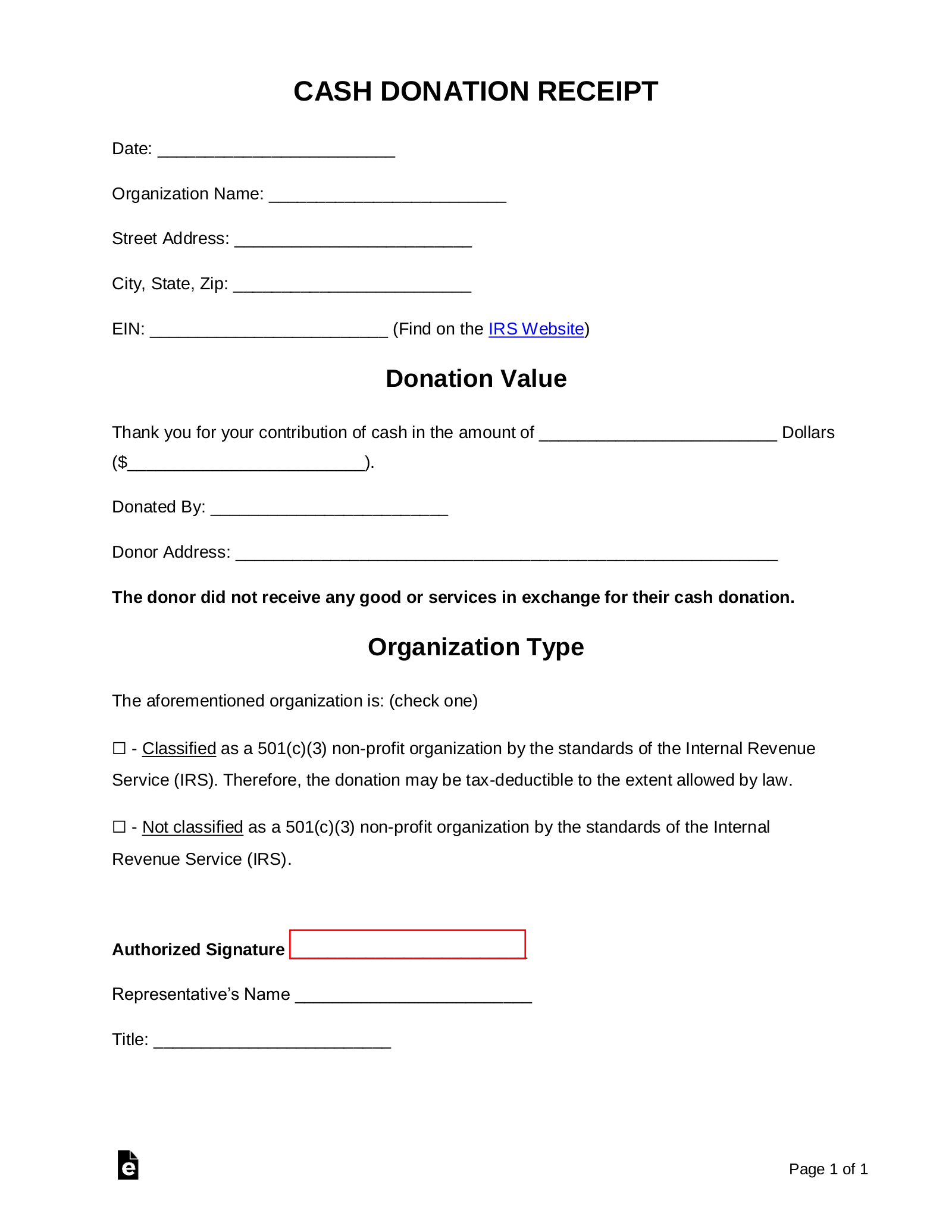

Free Cash Donation Receipt Pdf Word Eforms

Free Cash Donation Receipt Pdf Word Eforms

Sample Donation Receipts Free Download

Sample Donation Receipts Free Download

Belum ada Komentar untuk "8 Charitable Donation Receipt Template"

Posting Komentar