10 Portfolio Optimization Excel Template

Mean variance portfolio optimization with excel. An excel spreadsheet can be used in a number of ways to keep track of an investors holdings.

Ecommerce Portfolio Optimization Strategy Ppt Powerpoint

Ecommerce Portfolio Optimization Strategy Ppt Powerpoint

The template will show you the gain or loss for each stock between the original purchase and its current market value.

Portfolio optimization excel template. A series of sample stocks are included but the spreadsheet can be adapted. User guide for the portfolio optimization excel template by business spreadsheets user guide navigation. It includes just enough theory to ensure that we understand philosophical foundations of the subject and critically analyze optimization models for strengths weaknesses and breaking points.

Project planning and management multiple regression analysis and forecasting investment and business valuation real options valuation portfolio optimization portfolio performance tracking customer invoicing. The first step is to decide what data you would like to include. Portfolio modelling tool portfolio modelling tool.

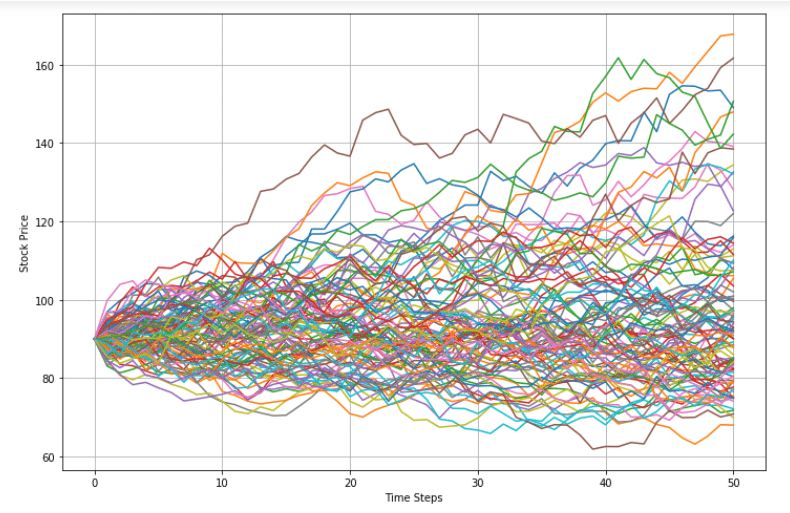

A ready to use financial template to help you understand the potential performance of an early stage investment. Risk assessment options and portfolio dynamics can be adjusted to analyze optimization on portfolios based on specific business requirements extrapolations and preferences. Portfolio slicer is a free for personal use excel workbooktemplate that lets you track your stock etfs and mutual fund investments your way.

Selecting asset and respective weights portfolio managers first choose the asset classes they want to allocate funds. Marketxls template has now made it easy to perform portfolio optimization with just a few clicks. Track the value of your stock portfolio by inputting the initial purchase and cost basis data and a current quote for each stock.

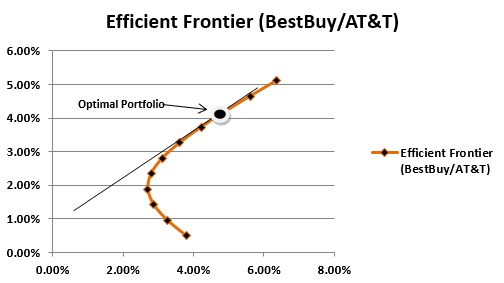

In this model we calculate stock returns the variance. Business spreadsheets user guides. This excel spreadsheet implements markowitzs mean variance theory.

The excel portfolio optimization template establishes optimal capital weightings for portfolios of financial investments or business assets to maximize return and minimize drawdown risk. The excel portfolio optimization model combines asset allocation and technical analysis to maximize investment returns. If you are comfortable with excel then you will love portfolio sliceryou will tell portfolio slicer about your investments by entering data into pre defined excel tables.

Of each stock and the covariances between stocks using the excel functions average varp and covar. An investor wants to put together a portfolio consisting of up to 5 stocks. The asset allocation for an optimal portfolio is essentially a two part process.

Portfolio optimization models in excel presents the foundations of a scalable framework that evolves as markets around us evolve. Best combination of stocks to minimize risk for a given return. It optimizes asset allocation by finding the stock distribution that minimizes the standard deviation of the portfolio while maintaining the desired return.

Tracking investments with excel. Using the markowitz method what is the.

Efficient Portfolios In Excel Using The Solver And Matrix Algebra

Optimization And Automation Of Excel Templates For Issuance

Optimization And Automation Of Excel Templates For Issuance

Portfolio Optimization Definition Amp Example Limitations

Portfolio Optimization Definition Amp Example Limitations

Portfolio Optimization By Using Excel Solver

Portfolio Optimization In Excel Model With Marketxls Add In

Portfolio Optimization In Excel Model With Marketxls Add In

Fixed Income Portfolio Management Excel Solver Fixed

Fixed Income Portfolio Management Excel Solver Fixed

Excel Portfolio Optimization Template

Free Net Worth Spreadsheet Money Under 30

Free Net Worth Spreadsheet Money Under 30

Belum ada Komentar untuk "10 Portfolio Optimization Excel Template"

Posting Komentar