8 Acquisition Due Diligence Checklist Excel

Due diligence checklist for acquisition of a private company description. Below is an example of a due diligence checklist for mergers acquisitions mergers acquisitions ma process this guide takes you through all the steps in the ma process.

Exhaustive Due Diligence Checklist For Buying A Business 2021

Exhaustive Due Diligence Checklist For Buying A Business 2021

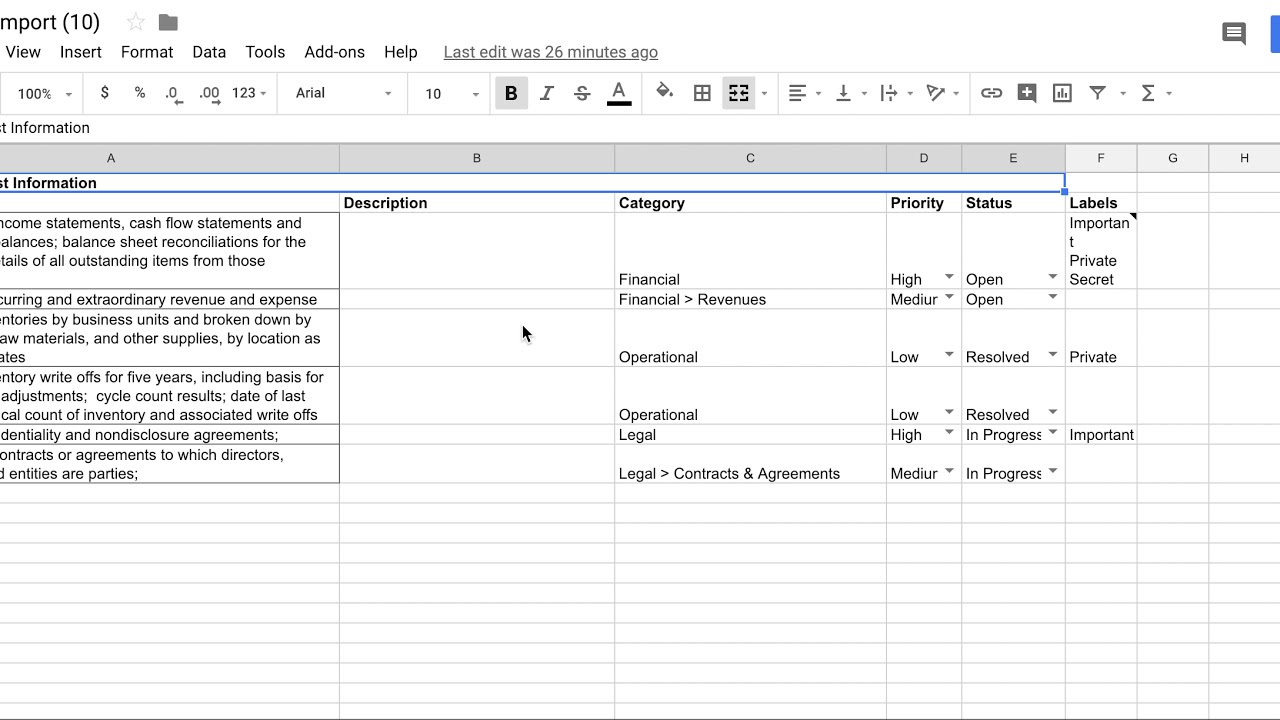

Dealroom is a due diligence management software and virtual data room that allows ma practitioners to easily upload checklists.

Acquisition due diligence checklist excel. Doing your homework collecting the necessary legal financial and operational documents and confirming the seller representations and material facts pertaining to the business sale are all part of the due diligence process. Easily collect data using this due diligence checklist in dealroom. Checklist helping you to be prepared for an upcoming due diligence process.

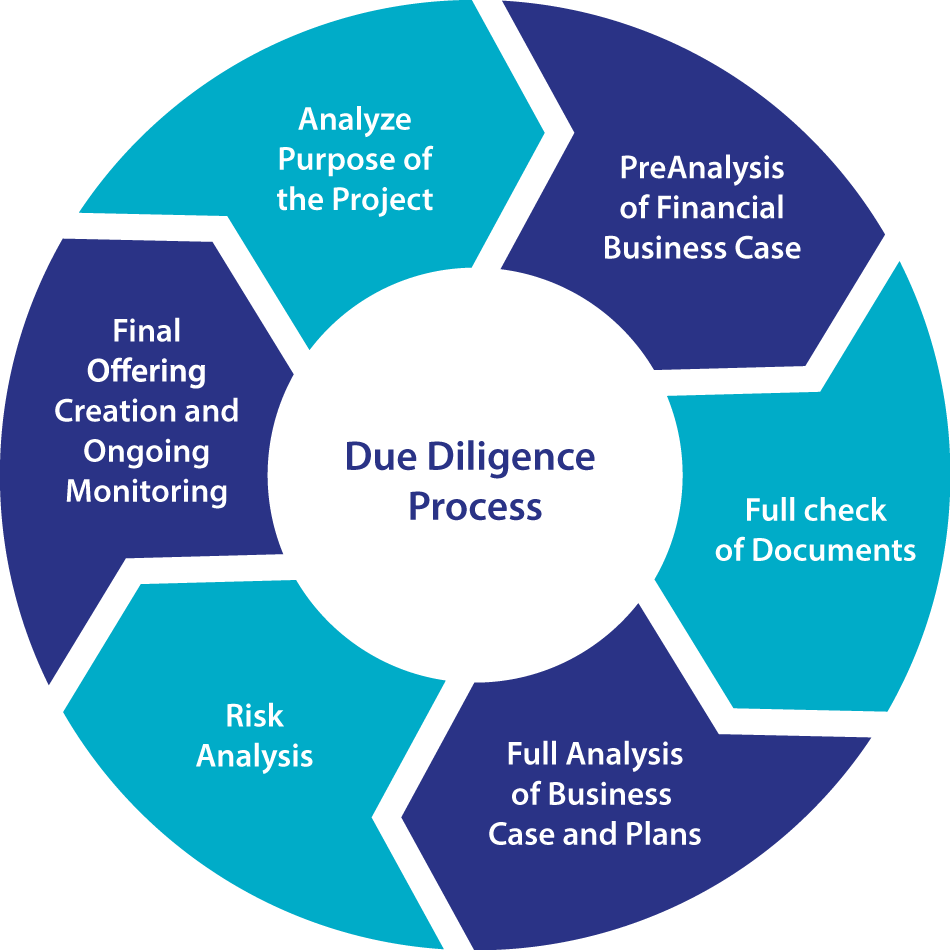

Due diligence checklist for acquisition of a private company description. We created the due diligence checklist to ensure your company does not miss anything during an acquisition. Due diligence is a process that helps determine the overall viability of a merger an acquisition or an investment.

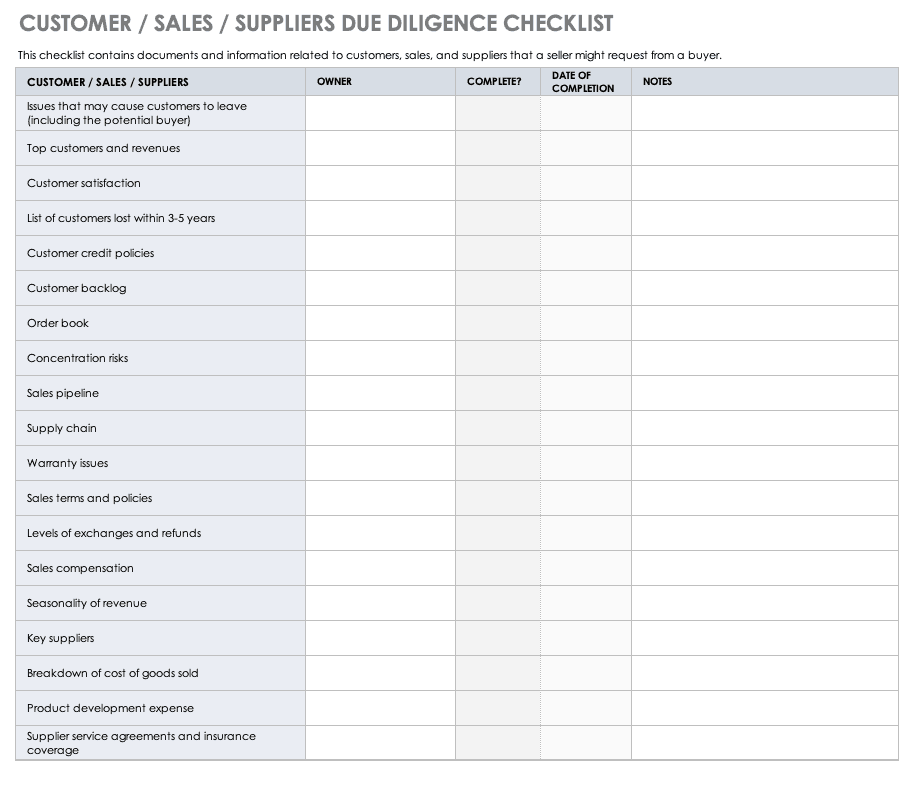

An investor or an analyst has to cover a variety of areas to conduct due diligence of a prospective deal. Use our acquisition due diligence checklist to help make sure you get the documents needed for an in depth understanding of target companies. Our template presents 200 items that you should consider during an acquisition including accounting and taxes financing services and license agreements intellectual property litigation legal compliance real property studies plans rd customers suppliers and more.

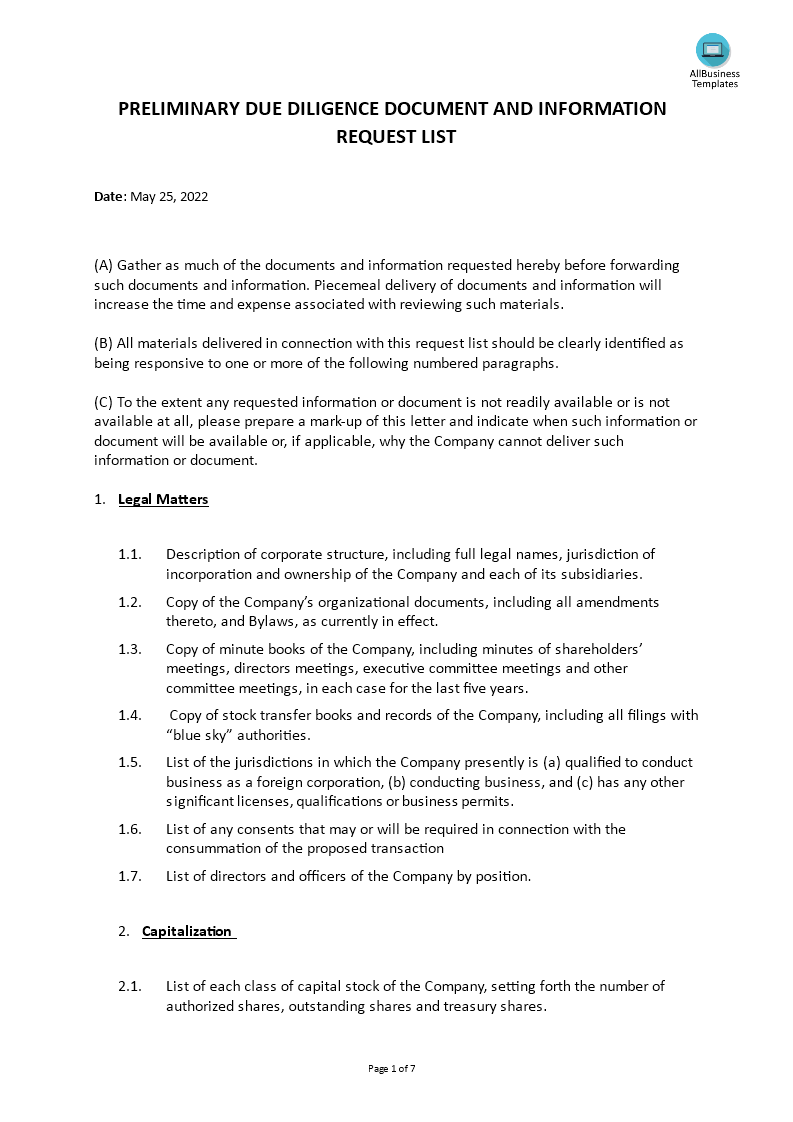

Dont manage your merger and acquisition due diligence checklist using excel. The operational and financial information that the seller provides to the buyer ensures that they overlook no details such as litigation risks and liabilities and that the claims about the state of the business are true. This is a comprehensive legal checklist to consider when reviewing the purchase of a privately held company.

Merger and acquisition due diligence is the process in which a potential buyer investigates the details of the target company starting after they sign purchase documents. 77 reviews 11800 views start the discussion. From a buyers perspective due diligence is the term that refers to the investigation and verification of information involved in a potential investment or acquisition.

This is a comprehensive legal checklist to consider when reviewing the purchase of a privately held more reviews. Therefore it is a common practice to make a due diligence checklist. Due diligence excel checklist.

In this guide well outline the acquisition process from start to finish the various types of acquirers strategic vs. Additional issues may be appropriate under the circumstances of a particular deal. Identify verify and mitigate risk with this acquisition due diligence checklist before fully committing to a transaction you must first prepare an acquisition due diligence report.

Learn how mergers and acquisitions and deals are completed. Bookmark download for free. By firmex deals can be complicated your data room shouldnt be.

Acquisition company checklist due diligence legal.

Types Of Due Diligence Know The Different Due Diligence Methods

Types Of Due Diligence Know The Different Due Diligence Methods

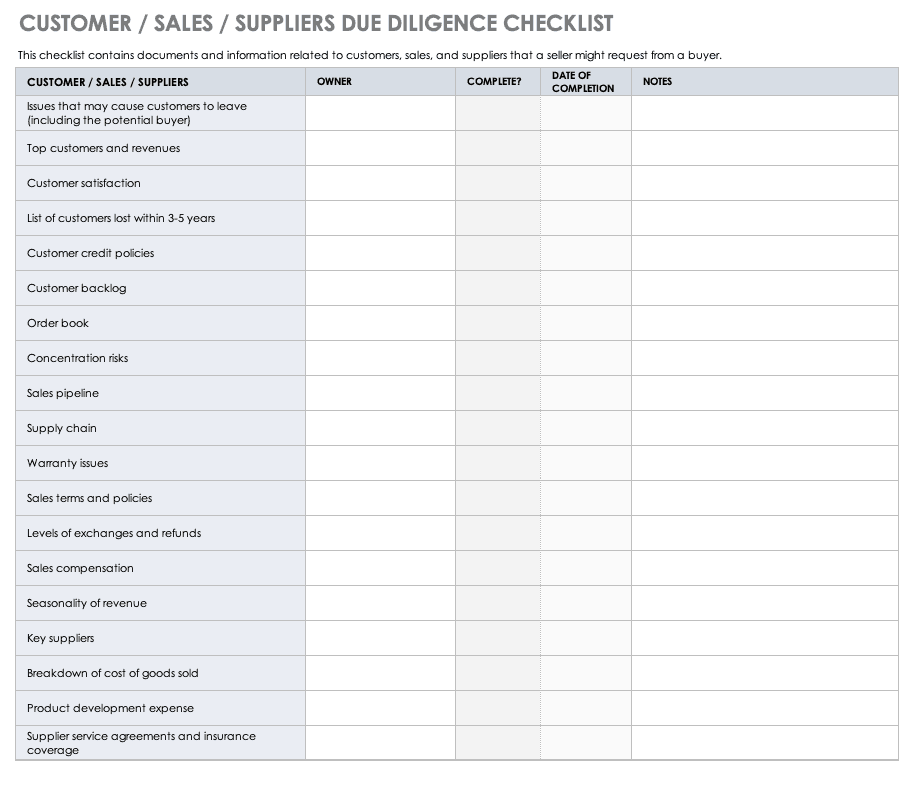

Due Diligence Checklist Demand Metric

Due Diligence Checklist Demand Metric

Due Diligence Checklist Templates At Allbusinesstemplates Com

Due Diligence Checklist Templates At Allbusinesstemplates Com

Commercial Real Estate Due Diligence Checklist

Commercial Real Estate Due Diligence Checklist

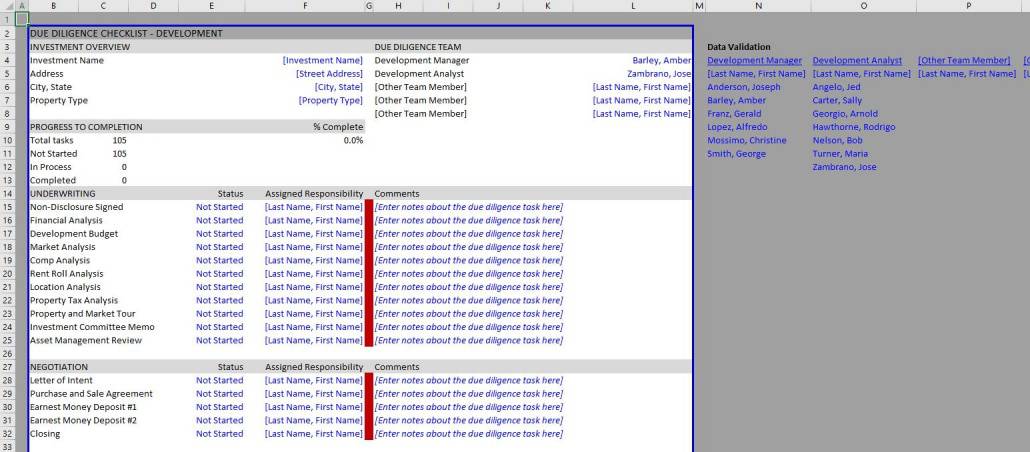

Real Estate Development Due Diligence Checklist Adventures

Real Estate Development Due Diligence Checklist Adventures

Due Diligence Types Roles And Processes Smartsheet

Due Diligence Types Roles And Processes Smartsheet

Due Diligence Checklist Real Estate Acquisitions Living

Due Diligence Checklist Real Estate Acquisitions Living

Belum ada Komentar untuk "8 Acquisition Due Diligence Checklist Excel"

Posting Komentar