9 Letter To Irs Template

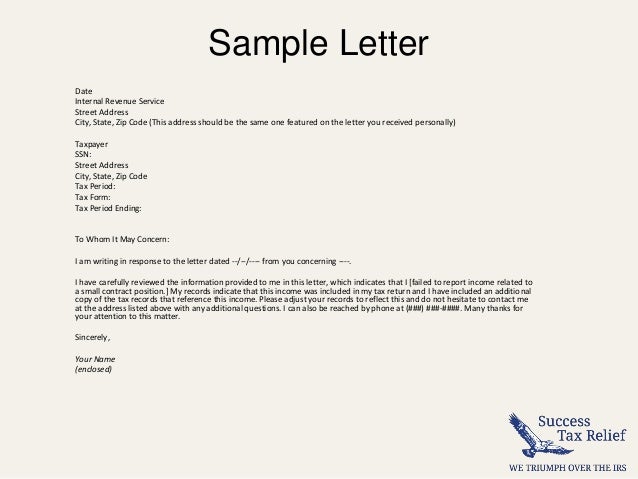

You can use this template as a guide to help you write a letter. However if you want to improve your chances of your request being accepted you should work with a tax professional.

This letter also always contains detailed explanations about the unique situation that led to the non compliance of the taxpayer alongside an explanation of reasons that qualifies the taxpayer for a waiver for the tax penalty.

Letter to irs template. Sample irs audit response letter. For example you can write i am writing to request an abatement of 451233 as assessed in the notice sent 732017. There are several key things to remember when writing your letter of explanation to the irs.

In the first paragraph of your letter explain why you are writing the irs. Understand why you are receiving the notice. The following documents are for the 2006 tax return audit.

The letter specifies the tax form that incurred the penalty a copy of which is generally included with this letter to expedite the irs review process. Make a copy of the notice you received from the irs and include it with your letter. Irs reasonable cause letter sample.

Curadebts professionals have years of experience dealing with the irs and can help you get back on track with your taxes in no time. You should always address this correspondence to the internal revenue service and send it to the address listed on the written notice of the tax due. Template available at the bottom 1.

This penalty abatement request letter is usually written to the irs to ask the irs to forgive a tax penalty for a reasonable reason. Letter to irs template letter to the irs template. Dear irs i have enclosed all the copies of the requested documents that you were asking for.

A letter to the internal revenue service irs is helpful if you need to make adjustments to your filing or dispute a finding by the irs. How to write a letter of explanation to the irs with samples if you are requesting a penalty abatement for a reasonable cause you can use the sample letter below to help write your request. These notices or letters explain the reason for contact and give you instructions on how to handle the citation.

The taxpayer is able to explain why they believe the penalty was incurred and the actions they are taking to correct the error which would lead to a justified reduction in the penalty amount. The following envelope has these documents inside. For example if you dont agree with their assessment or want to give notice of steps that you are taking a letter to irs is a tool that can be used in a variety of different situations.

Internal revenue service use the address provided in your tax bill. Here is a sample letter to request irs penalty abatement. Mention the date of their notice.

Sample irs penalty abatement request letter. Sending a cover letter in addition to a resume assists you build your brand name the very same means an advertising and marketing firm advertises an item s brand name. Here is a simplified irs letter template that you can use when writing to the irs.

Non Cash Contribution Letter Template

Non Cash Contribution Letter Template

How To Change Your Llc Name With The Irs Llc University

How To Change Your Llc Name With The Irs Llc University

Irs Audit Letter 2202 B Sample 1

How To Write A Letter Of Explanation To The Irs From Success

How To Write A Letter Of Explanation To The Irs From Success

Irs Letter 566 Cg 2010 Fill Out Tax Template Online Us

Irs Letter 566 Cg 2010 Fill Out Tax Template Online Us

Irs Cp2000 Response Form Pdf Awesome Outstanding Payment

Irs Cp2000 Response Form Pdf Awesome Outstanding Payment

Belum ada Komentar untuk "9 Letter To Irs Template"

Posting Komentar